Are ‘Buy Now, Pay Later’ Schemes Contributing to Poor Mental Health?

When it comes to shopping, some of us are tempted to throw in that extra bag of snacks before reaching the checkout, or buying that dress for that ‘just-in-case’ occasion. It’s on special, it’s on sale. How could anyone turn an offer down like that?! In fact, we’re in a society where many people treat shopping as retail ‘therapy.’

Cleveland Clinic’s article summaries that a little bit of retail therapy affects us by:

Giving us a sense of control.

Visually distracting us from anxiety.

Releasing Dopamine from the point of thinking about shopping.

With those benefits, it’s not surprising that we fall into the trap of buying just one more thing. But it begs the question; where to we draw the line?

It might seem simple. You stop spending when there’s no money left to spend. However, with the increase of online shopping, comes the increase of credit options at checkout. That line we drew? It’s now very hazy.

What is Credit and Why Is It So Popular?

Most of us will be familiar with Credit options, but if you’re a younger reader, or have seen the growing number of websites advertising financial service such as Klarna or ClearPay, we’ll give you a little insight.

Buying something on credit basically means that you are buying now, and promising to pay in the future. This can come in different forms, from Credit Cards to options such as Monthly Instalments or Buy Now, Pay Later.

Wait, so I get to have the thing now… and not pay it for a year? Great!

Slow down there sunshine. Let’s talk.

Most of us will use credit in some form or way in our lives. When life gives you lemons, it squeezes them in your eyes in the form of your washing machine breaking two weeks before payday. It happens. Life’s a lemony b*tch sometimes. Hop online and grab a washing machine for £400; can’t afford it now? You have a year on Buy Now, Pay Later to pay the £400 before interest gets added. And this is where they draw you in.

Whether it’s interest free for a period of time, small monthly repayment options or low interest rates; they’re tempting you in with a ‘more affordable’ option.

One of the online clothes stores I previously bought from gave breakdown’s for each item of clothing.

The picture above was taken from an online clothes store. They display credit option underneath nearly every item in their store. This was their credit options for a £17.50 hoodie. I can imagine myself as a young college student, and if these options were available, I’d be drawn in too. £2.92 a week? That’s nothing!

It doesn’t matter if you’re a struggling student, a person two days before payday needing a dress for a wedding next week or a family with a broken fridge and no savings; credit appeals to a variety of people. The short term affects are great, as we’ve read. The enjoyment, the experience, receiving the package… But then the long term catches up to us.

How Does Credit Affect Mental Health?

Statistics from Money and Mental Health show that (in England) over 1.5 million people experience both debt problems as well as mental health difficulties. That said, it also highlights that 1 in 5 people with mental health are in problem debt and 72% of those who participated in the survey, said that their mental health had made their financial situation worse.

Credit exploits you when you’re low; scrolling aimlessly through a clothes shop or even online candy stores, and something that catches your eye releases the happy chemical in your brain. No money, no problem. There it sits, just underneath the debit/credit card option: “Finance.” You’re happy, you’ve treated yourself and it’s only £5 a week for 6 weeks. Your package arrives, hip hip hurray! But by week 3 the enjoyment wears off and you’re still paying that £5 a week that could pay for a cup of coffee with a friend. You pay for the credit option later… in more than one way. That positive feeling turns into a negative and once again, makes you vulnerable to start the cycle again.

It also provides you with a false sense of security with your budget. You start to think you can afford things that you wouldn’t normally buy up front. Handbag, shoes, jacket, suit and tie with branded names. You wouldn’t afford this paying right here, right now. But now you can. Can’t you?

Now you may think that £5 a week for 6 weeks isn’t that much. It’s only £30. Then next week comes and you don’t have any milk and bread and it’s another week before pay-day but you notice the £5 you should have had left, has just been removed from you’re account. You still have a week to go, so you delay your payment. The company adds a late payment fee; another £5. That’s when the problems start. Even with credit instalments of £5.

You might be thinking; Beth. It’s £5. It’s nothing.

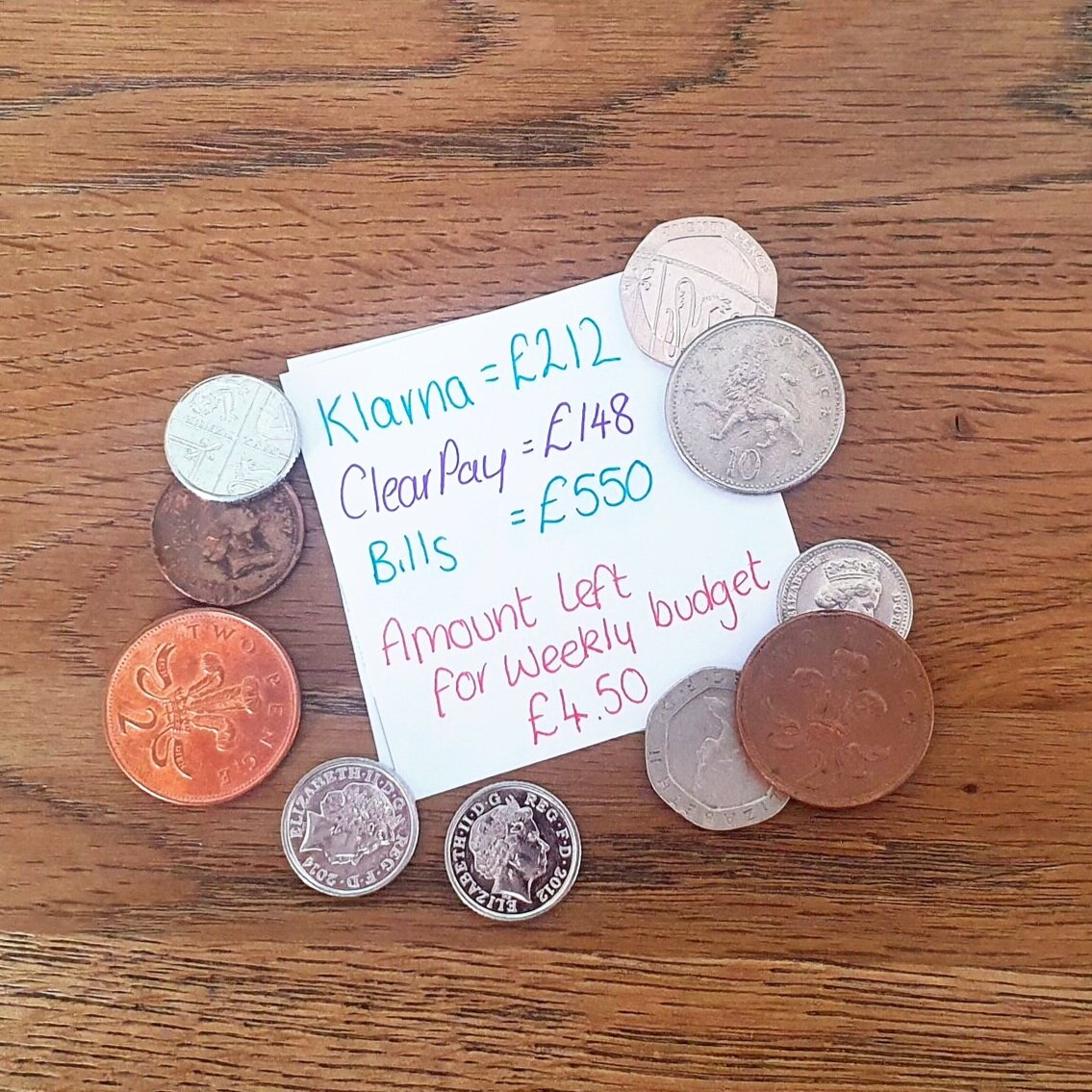

Credit makes you think you can afford items that you wouldn’t dream of being able to buy, but it’s not always positive. If you’re a teenager carelessly adding another few t-shirts to your Klarna account, it’s the start of a very slippery slope. It’s not healthy for your long-term money management. A £5 weekly payment turns into £30, then £100.

Looking After Your Mental and Financial Health

Now, I want to be clear. Credit can be amazing in situations. When a necessity breaks, like a fridge or a cooker, and you’re on a low paying job; it’s a great opportunity to replace something that you need. I’m not bashing credit completely, it’s been around for a long time. The problem I have is that it’s everywhere! Before, you could only use credit or finance options on items over £200 or £500. Now you can get it for knickers. Credit was something for adult products; you would only the occasional teenager in college buying a fridge on credit. Now, so many students are in debt with financial lenders because of dresses, tops, and yes, I’ll say it again, knickers.

With the underwear rant out the way, how can you help your financial and mental health? Well, there’s a few ways.

Know Your Budget and Be Realistic

If you do one thing on this list, let it be this. Know your income and outgoings. Know your average spending on each category, i.e. food, bills, direct debits, insurance, fuel. Once you know that everything you need to pay is covered, look at the rest of your budget. Then prioritise the items you feel you want most. It might be a haircut each month, or a beauty budget, or a budget for your favourite magazine.

Once that’s all out of the way, it’ll give you an idea of whether you earn enough to cover what you need to live comfortably. If you have excess, great! Maybe you could afford to buy something upfront after a few months of saving, or even right now. Maybe you can afford a credit agreement plan.

If you are just covering the costs of living comfortably, then you really need to consider whether credit is the best thing to go for. You could try and cut back in areas, but that may impact on your routine, and you’d have to be prepared for that. For example, if you needed to cut back your fuel budget and walk to work more often or take public transport, you’d have to account for the extra time to get there and whether it fits around your schedule. It’s all about prioritising and re-evaluating what works and what doesn’t.

Is it Necessary? Do you Really Need it?

Like I’ve said above, credit is extremely useful when you have a necessity that needs replaced. White goods or furniture especially. There’s no problem with that, unless you’re on a low income and the repayments are hard to keep up with. In that case, seek alternative. You’d be surprised by how many charity shops and outlets have discounted new white goods for a fraction of the selling price.

When it comes to the smaller items, really consider whether you need it. Is this dress going to cure your sadness or will the joy wear off quickly. Is there something that would cost less, or something that you already own that would give you a sense of joy? If not, there’s no harm in ordering a few items.

If you’ve found your shopping cart loaded with items when you only planned on ordering one or two things, consider the urgency of what you need. You can keep a list of the other things in your cart and purchase them at a later date (they might even be on sale then!)

Avoid Email Subscriptions

If you’re easily enticed into sales, it would be a good idea to unsubscribe from all those online stores that send you daily or weekly offers. I didn’t know this was possible until a couple of years ago because the ‘unsubscribe to these emails’ is usually in tiny print at the bottom of the page. If it isn’t an option, you can also mark it as Junk/Spam. Don’t worry about order emails from those websites going into your Junk folder either; because they come from a different email address, they’ll not be lost.

Check the Small Print

It’s easy to be sucked into the glowing, glaring low prices and interest-free banners on credit options. It’s less easy to read the full terms and conditions of the agreement. (You know what I mean, pressing the ‘Accept’ button on Terms and Conditions without even opening the document. You know!)

Ensure you read the terms and disclaimers. A lot of companies add a large amount onto your credit if you miss a payment or delay a payment, some companies actually add on charges for each day you miss your payment. Be aware of what the companies procedures are, just so you can be prepared. The same rules apply for interest free for a set time. Check what interest will be added if you don’t pay back the amount before the interest free time is up.

Seek Debt Advice

Debt isn’t something to be ashamed of, as many people experience debt at some point in their lives; whether it was planned or not. A lot of people choose to fight their debt battles alone, and it doesn’t have to be the case. Their are lots of free debt advice services around. They can help you develop a sustainable plan to pay your debts and manage your budget in the long term.

If you’re in the UK, check out Step Change. Step Change is a debt charity with lots of useful information, tools and helplines to help you deal with debt. In the USA, you can check out the NFCC website which also offers a free helpline and debt management tools.

Credit can be useful in the right situations, but be careful not to let it impact your life. Financial strain and debt are a common cause for depression and stress in other areas of your life. Always consider your options and never jump straight into using credit without reading the details, or you might end up with some nasty, and costly, unwanted surprises.

If you’re looking for more ways to keep on budget, you can check out our article here on (Online) Shopping and Budgeting.

I am not trying to give these companies negative publicity, I am strictly using them as examples of credit finance companies. There are hundreds out there, but these are the ones most people will come across. That, in no way, means they are the worst out there. Their names are being used as examples in line with the advice and discussion in the article.

Until next time, stay happy, stay healthy and stay positive. And remember, someone out there cares about you, so if you need help or feel like chatting, reach out.

Beth