(Online) Shopping and Mental Health: 5 Tips for Budgeting

Before writing this article, I tried to do some research to see other people’s recommendations and insights into finances and mental health/mental illness. I was surprised at the lack of content.

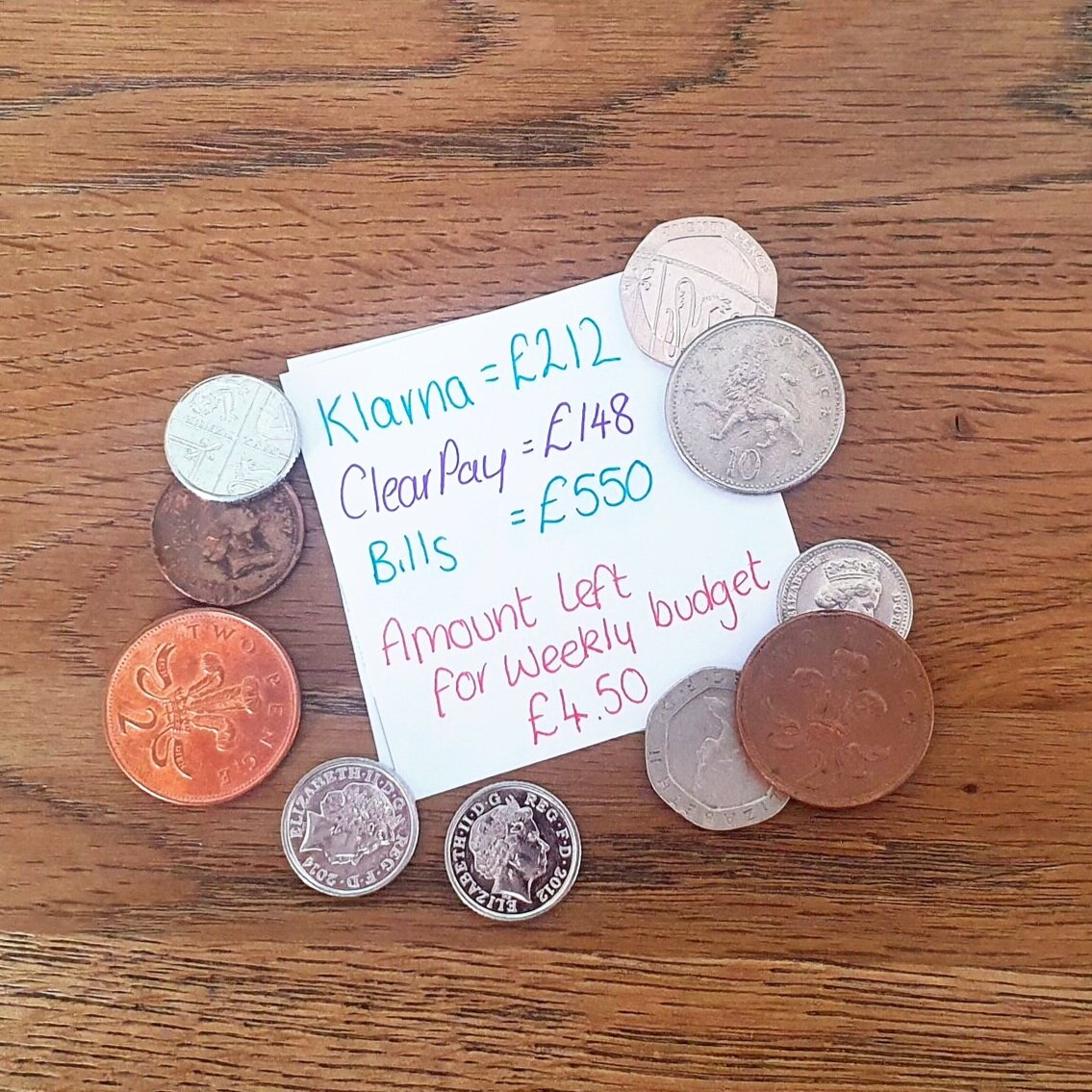

One of the main areas that I support people with in my current job is to budget and manage their finances. Drawing on my own experience with mental illness, I know why. I know how hard it is to stay financially stable and prioritise when you’re mental health is low/high.

Online shopping is dangerous… I’m looking at you Amazon Prime…

Despite the lack of content out there on the interwebs, financial stability can severely impact your mental health, and mental health can severely impact your financial stability. Life can be stressful enough without having to worry about losing the roof over your head or putting food on the table.

In this article, we’ll be talking about different ways of managing your finances to increase your likelihood of financial stability and reducing the impact it has on your mental health. We’ll be looking at both sides; managing finances with mental illness and managing finances to reduce stress and this impacting on your mental health.

What I want you to remember however is…

You Deserve to Treat Yourself!

Take these suggestions and apply them to yourself as you please, but remember and allow yourself a little bit of leeway now and again. You are allowed to buy things for yourself to make yourself feel good, whether this be take-away food, a meal out, a trip to the cinema or a new pair of shoes. Not everyone needs to have material things to feel good, I understand that, but don’t let yourself fall short of something you either need or want because of the fear of not having enough money by the end of the month. If you save enough or have the money spare, you are 100% worth spoiling. Because you’re amazing!

How To Look After Your Finances When You’re Mental Health is Poor/To Avoid Poor Mental Health

Envelope systems for managing your budget is a great way to physically see your money and manage it appropriately.

Set A Realistic Budget Plan

This may seem so basic that you’re wondering why I’m even mentioning it. The problem with this nowadays is that we forget about all the subscriptions that we forget to cancel after the free period and online orders we place at midnight when we’re bored. Yes Amazon Prime, I’m looking at you.

The reason I recommend this first and foremost, is because your budget can change month to month. My budget changed dramatically from December 2019 to January 2020, mainly because I dropped my contract by 8 hours. I had to cancel monthly subscriptions, tighten how much I spent on toiletries and clothes and take into consideration the increase in the price of food.

Budget planning should ideally be done on the day you get paid. Prioritise your bills and essential expenses such as travel; then divide up what you have left between other categories, including savings. If you can, always put away money, even if it’s not for anything in particular. A rainy day fund never goes wrong and you’ll thank yourself later.

If you’re struggling to save, think of one of the luxuries you could go without. Now that could be cancelling a subscription that you don’t really use, swapping branded foods for cheaper alternatives or skipping on a meal out and opting for home cooking. Even if it’s a few pounds a week, they’ll amount up. Say you put away £5/$5 a week for one year, that’s £/$260. Is that luxurious whipped cream, double shot coffee worth it, or would you rather know you have the money aside to replace your cooker if it ever broke? Food for thought!

Savings are also beneficial if you are prone to online shopping as a coping mechanism for dealing with low mood, or a symptom of hypomania/mania in bipolar disorder. When you’re in a stable place, I urge you to get as much savings behind you as possible. It’s the best thing I have ever done. Knowing you have that safety blanket for your bills is the most reassuring thing when coming out the other side of an episode or period of poor mental health. You might not realise it at the time, but future you will give you a giant pat on the back.

Consider Whether Credit Cards/Loans are a Good Idea

Building credit with a mental illness is something we’ll go more in depth with in a future article but on a quick note, don’t fall into advertisements for credit cards and loans if you’re not financially able to pay them off.

I am not an advocate for pay day loans, in fact, I could boldly say that they should be banned. At first, they may seem to be the quick fix for financial struggles but in the long run, they will begin to negatively affect your financial stability and later, you're credit score.

Credit cards and more commonly, pay day loans, have high interest rates which could lead to further debt if they’re not paid off in a timely fashion. Most local councils have Credit Unions which offer more secure loans which you can pay back at a rate that suits you. Credit Union customer service advisors are also well trained in mental health and wellbeing, and are able to listen to you and offer advice with your financial circumstances. You don’t get that with larger companies that are out to make money. When in doubt, stay local. You can learn about the benefits of Credit Unions here.

Open Another Account with a Different Bank, with No Card

I did this over four years ago, and it was the best decision I made for that time. It’s more easy now to do this as online applications can be approved for a different bank in a matter of hours.

I switched from opened a second bank account and turned it into my ‘no spend’ account. I didn’t have a card for this account, nor did I set up online or telephone banking. The aim of this is, if you don’t trust yourself enough to not dip into a savings account with your current bank, you have the extra security of not being able to access the account without going into a branch.

Once I had a budget set up, I transferred money into this account, which always had enough to cover bills and essential outgoings. All these were set up for direct debit, so I didn’t have to worry about using my card or putting in my details every time.

The benefit of this system is that providing you put your outgoing money across into the account, you always know your bills will be paid. Any extra money goes into my other account where I can use my card freely. I have that sense of security that even if I splurge to make myself feel better or have a moment of stress purchasing, all my important bills are covered.

Shop in Store, Not Online

The temptation of online shopping is everywhere. Adverts on social media, Newsletter emails, offers of discounts and sales; they are all attempts to lure you in and spend money. We’ve all fell into their trap. It’s convenient, it’s often quick with the option of next-day delivery and you can spend hours browsing through items you wouldn’t usually find in high-street stores. The convenience comes with a cost. When do you say no? How much is too much?

When you shop online, you can’t physically see what you are buying, so you lose the sense of knowing whether you’re going overboard. Browsing the shops and piling up items into your arms is considerably different. You’re more likely to go in and buy what you need then go home. Whereas with online shopping, your chances of adding ‘just one more thing’ increases the more you browse.

Opting for buying in store only increases your chances of limiting your spending and controlling your impulse buying. You’re also supporting your local and independent shops to stay open! In the current climate, more and more shops are closing their doors because we’re choosing the easy option of shopping online. If retail chains aren’t able to compete with that level of convenience, how are family run businesses going to stay open?

Change the way you shop and support your community. Shopping in store also gets you off your bum and out your house, supporting your physical health as well. Is that Amazon Prime subscription really worth it?!

Consider Going Cash Only

The final recommendation I have is to ditch the plastic and use cash payments. In the picture on the page, you can see envelopes that I bought for splitting up my money into categories. This is something you can’t do with your bank account and can be incredibly helpful if you’re prone to going over-budget.

By withdrawing your money for areas that can be paid for with cash, you know and can see exactly how much you have to spend for that month. This is especially handy for when you go out and do your shopping. You can take these envelopes with you , or divide your money in your wallet/purse and leave your card at home. Over-spending isn’t an option this way, or if you do go over budget, you have to dip into another area’s budget, which will make you less likely to spend over the amount you have assigned.

Unfortunately, I think we’re more likely to overspend due to the new Contactless feature on debit/credit cards. We can mindlessly tap our card away to pay for items, without even putting a pin number in.

Why not try the cash only method? It might make you realise how much you spend and make you rethink your budgeting! Or do you have your own budgeting methods that I’ve not mentioned above? Share them in the comments below.

I’d like to give a special thanks to Barclays and Lloyds Bank for highlighting Mental Health and providing helpful links on their websites as well as sign-posting to charities within the UK. More banks need to follow suit and have a kinder and more understanding approach towards customers’ mental health.

Until next time, stay happy, stay healthy and stay positive. And remember, someone out there cares about you, so if you need help or feel like chatting, reach out.

Beth